聚光灯

风险经理、内部审计员、认证副主管、认证经理、合规总监、合规运营经理

Every organization on Earth has some sort of financial structure, whether it’s a “mom and pop” store, a nonprofit, a company, an insurance firm, or a government agency. And whenever money is involved, you can bet there are rules and regulations about how that money gets used. That’s why most organizations have at least one dedicated Financial Compliance Officer on staff to keep them out of legal trouble.

Financial Compliance Officers carefully review balance sheets, income statements, and other financial documents. They meticulously screen for discrepancies and ensure compliance with applicable federal and state regulations (plus any other guidelines they’re asked to watch out for). Their goal is to find and prevent oversights, errors, and fraud that could impact the integrity of their employer’s finances.

"我的工作是对我们当前的政策、程序、实践和工作流程进行审查,以了解我们是否遵守了所有州和联邦法律。如果我发现有可以改进的地方,我会帮助制定旨在降低风险的计划。我还负责审查和评估供应商合同,以确定该公司是否能提供所需的服务,是否为支持我们的整体需求做好了充分准备,然后签订实际合同。我的一项重要工作是每月对业务实践进行风险评估。我帮助确定可以改进的地方,然后将这些意见传达给管理人员,并帮助制定更好的文件流程和质量控制审查。"阿拉斯加美国 FCU 合规经理 Jarrett Wright Carson

- Playing a critical role in preventing financial misconduct and crises

- Opportunities to work in a wide range of organizations

- Collaborating with teams to enhance compliance and risk management

"我的员工能够帮助客户和公司其他部门,这就是我工作的好处。我可以指导、培养和训练我的员工,使他们成为领导公司的下一个管理团队。"阿拉斯加美国 FCU 合规经理 Jarrett Wright Carson

工作日程

- Financial Compliance Officers typically work full-time, with the potential for overtime during audits and examination periods.

典型职责

- Develop and implement risk management strategies and compliance audit plans, procedures, documentation, databases, and tracking systems

- Forge relationships with stakeholders to ensure effective communication and cooperation

- Conduct internal audits, self-assessments, and thorough reviews of financial statements and records to ensure compliance with regulations and identify potential risks and irregularities

- Prepare detailed reports of findings and recommend corrective actions

- Monitor ongoing compliance; follow up on previous findings to make sure they’ve been addressed

- Evaluate the effectiveness of internal controls. Recommend improvements, as needed

- Ensure institutions adhere to federal and state laws and regulations, and submit accurate and timely regulatory filings and reports

- Ensure compliance with anti-money laundering and know-your-customer regulations

- Collaborate with legal and regulatory teams; liaise with external regulatory bodies and auditors

- Train staff on compliance requirements and best practices

Investigate complaints and potential violations of financial regulations - Implement and oversee whistleblower policies and procedures

- Conduct special investigations into potential financial misconduct or regulatory breaches

额外责任

- Stay current with financial regulations and examination techniques

- Engage in professional development opportunities

- Provide guidance and support to junior officers and other staff

- Assist in the preparation for regulatory examinations and audits

"我的典型一天首先从开会开始。我总是尽量召开团队会议,以确定部门内需要完成工作的优先次序。在这次会议上,我会重点讨论工作的优先次序,确保我和我的团队意见一致,然后确保我知道是否有任何可能出现的问题。沟通是关键。首次会议结束后,我通常会查看我的每日和生产跟踪记录。这样我就能看到我的 "待办事项清单 "上有哪些事项、优先级以及谁需要做。然后,我就开始挑选优先级最高的项目或可以最快完成的项目,慢慢处理清单上的工作。这有时需要大量阅读合同、法律文件、联邦或州法律等。午餐后,我会换个方式,开始关注团队的培训工作。我们负责制定培训计划,这样我就可以心无旁骛地专注于这一领域。一天即将结束时,我会对我的团队所完成的工作和我所做的工作进行非正式回顾,然后为第二天的工作和晨会制定计划"。阿拉斯加美国 FCU 合规经理 Jarrett Wright Carson

软技能

- 积极倾听

- 适应性

- 分析性的

- 以合规为导向

- 批判性思维

- 注重细节

- 纪律

- 金融敏锐度

- 诚信

- 耐心

- 坚持不懈

- 劝说

- 规划和组织

- 解决问题的能力

- 怀疑主义

- 健全的判断力

- 强大的沟通能力

- 团队合作

- 时间管理

技术技能

- Data analysis and interpretation, using tools like Microsoft Excel, Tableau, or SPSS to identify trends and anomalies

- Familiarity with regulatory compliance software such as SAS, MetricStream, or IBM OpenPages for monitoring and ensuring compliance

- Knowledge of financial regulations and standards, utilizing tools like Wolters Kluwer Compliance Solutions

- Proficiency in financial analysis and auditing techniques and programs, utilizing software like QuickBooks, SAP, or ACL Analytics for thorough financial reviews

- Report writing, using Microsoft Word or Google Docs

- Risk management, employing tools like Archer or RiskWatch to develop and implement effective risk mitigation strategies

- Understanding of banking and financial systems, using platforms like Fiserv, Jack Henry, or Oracle Financial Services to manage and oversee banking operations

- Banks and credit unions

- Companies and corporations

- Financial consulting firms

- 政府机构

- 保险公司

- Investment firms

- 非营利性组织

Financial Compliance Officers are expected to maintain high standards of accuracy and integrity. Their role is crucial in identifying and mitigating risks within their employing institutions. There’s a ton of pressure to ensure compliance and avoid fines or sanctions, so they must be vigilant and detail-oriented because even minor oversights can lead to significant repercussions.

The job requires extensive research and continuous education to keep up with changing laws and regulations. Hours can be long and the role can be stressful at times, but there’s job satisfaction from protecting organizations and consumers from financial misconduct. Also, the skills and experience gained in this role can open doors to advanced positions within the field!

The financial industry is increasingly utilizing technology to improve compliance processes. Automation, artificial intelligence, and blockchain are becoming integral in detecting irregularities and ensuring transparency. Regulatory Technology solutions are on the rise, helping compliance officers manage regulatory requirements by streamlining reporting, enhancing risk management, and reducing the time and cost of compliance activities.

There’s also a growing emphasis on sustainable finance and environmental, social, and governance regulations. Financial compliance officers are thus charged with ensuring their institutions adhere to these strict standards and exhibit more responsible corporate behavior!

- 玩棋盘游戏,探索游戏规则。

- 阅读书籍和解决问题。

- 让个人物品井井有条。

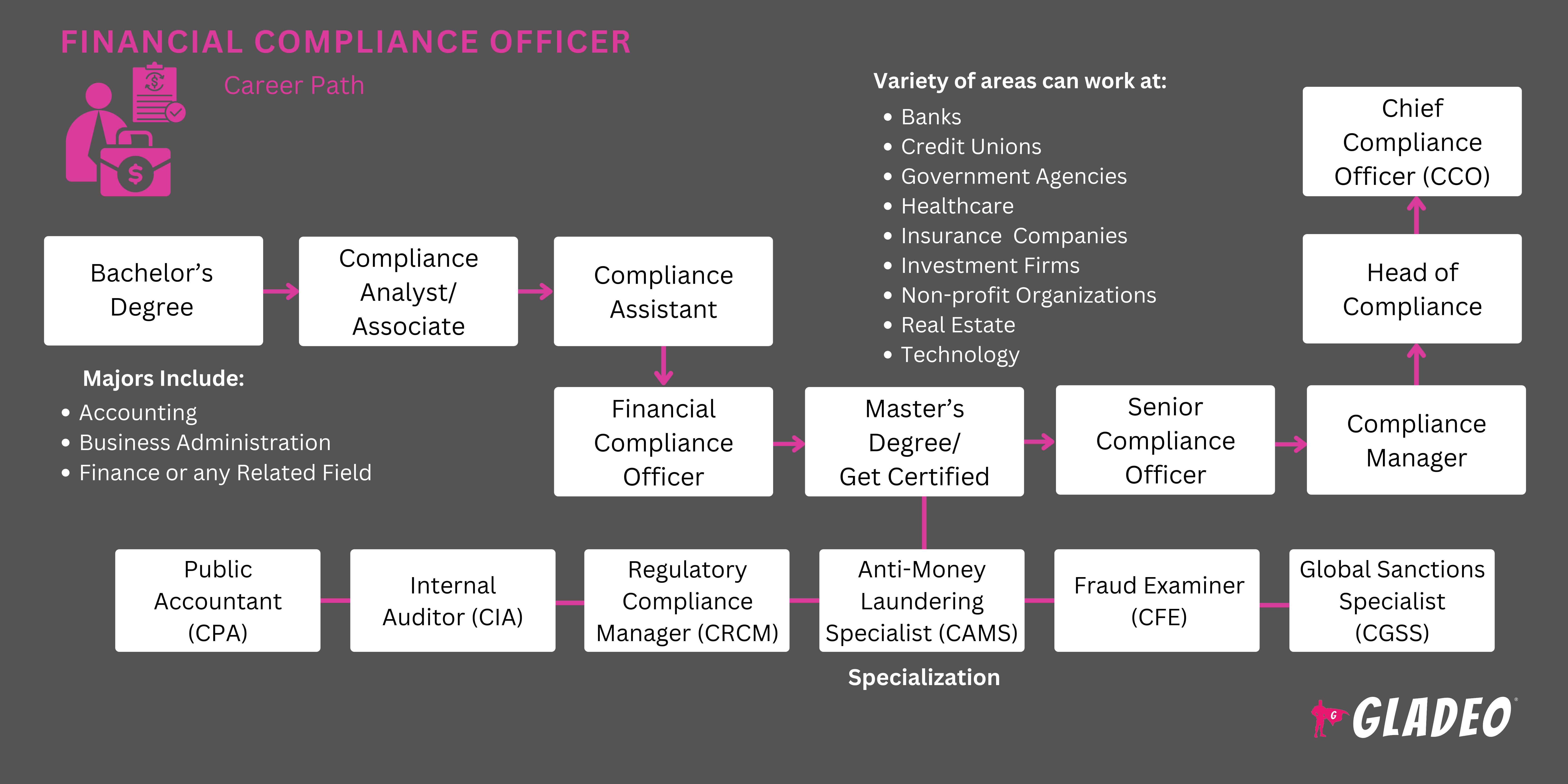

- A bachelor’s degree in finance, accounting, business administration, or a related field is typically required to get started. However, relevant work experience is also essential. Some companies offer on-the-job training, internships, or other mentorship programs, but most Financial Compliance Officers still have to work their way up to the role

- Workers require in-depth knowledge of finance, auditing, compliance, financial regulations, and standards. They should also be proficient with compliance and financial analysis software and must understand risk management principles and practices

- Continuous professional development (via classes, certifications, conferences, workshops, and seminars) is needed to stay updated on regulatory changes and industry best practices

- Advanced positions may require a master’s degree and/or additional certifications such as:

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Regulatory Compliance Manager (CRCM)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Certified Global Sanctions Specialist (CGSS)

- Look for reputable, accredited college programs in finance, accounting, or business administration, with programs emphasizing financial regulations, auditing, and compliance.

- Decide early if you plan to pursue a master’s. It may be easier to complete a bachelor’s and master’s at the same school, perhaps via a dual program.

- In addition, consider the following:

- Costs of tuition (including in-state versus out-of-state tuition rates).

- Discounts or scholarship options.

- 联邦援助是否有助于支付费用。

- Whether to enroll in an on-campus, online, or hybrid program.

- The experience and achievements of the faculty.

- Opportunities for internships or cooperative learning.

- 毕业生就业统计和有关该计划校友网络的详细信息。

- 努力学习数学、金融、经济、统计、商业、物理和计算机科学/编程课程

- 担任学生活动的志愿者,在那里你可以管理金钱并学习实用的软技能

- 考虑申请会计或财务方面的兼职工作

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working compliance officers to learn more about their jobs

- 在大学里寻求实习和合作经验

- 记下可能作为未来工作推荐人的姓名和联系信息

- Study books, articles, and video tutorials related to financial laws. Participate in online discussion groups

- 参与专业组织,学习、分享、交朋友,并发展你的网络(见我们的资源清单>网站)。

- Knock out any relevant certifications as soon as you can to bolster your credentials and make you more competitive in the job market

- 如果可能的话,在申请前获得一些实际工作经验。与金融、会计和商业相关的工作在申请中会显得很有吸引力。

- 在这一领域开始工作不需要硕士,但研究生学位可能使你在竞争中领先

- Let your network know you are looking for work. Most job opportunities are still discovered through personal connections

- 查看Indeed、Simply Hired 和Glassdoor 等招聘门户网站,以及您感兴趣的公司的职业页面

- Check out a few online Financial Compliance Officer resume templates for formatting and phrasing ideas

- Screen job ads carefully and only apply if you’re fully qualified. Include keywords in your resume, such as:

- AML/KYC Compliance

- Artificial Intelligence in Compliance

- Audit Procedures

- Blockchain Technology

- Compliance Databases

- Data Analysis (Excel, Tableau, SPSS)

- Financial Analysis

- Financial Reporting

- Financial Systems (QuickBooks, SAP, Fiserv)

- Internal Controls

- RegTech Solutions

- Regulatory Compliance Software (SAS, MetricStream, IBM OpenPages)

- Risk Management (RSA Archer, RiskWatch)

- 与金融有关的学徒或合作经历可以帮助你进入大门。它们在简历上看起来很好,而且可能为以后提供一些个人参考。

- Move to where the most job opportunities are! Some states with the highest employment level for finance jobs are New York, California, Texas, Illinois, and Florida

- 许多大公司从当地的项目中招聘毕业生,所以请你学院的项目或职业中心帮助联系招聘人员和招聘会。

- 职业中心还提供简历撰写和模拟面试方面的帮助!

- Ask former teachers and supervisors if they’ll serve as personal references. Don’t give out their contact info without permission

- 在Quora上开一个账户,向该领域的工作者提出工作建议问题。

- Financial Compliance Officer interview questions to prepare your responses. Sample questions might include: “What are the key regulatory frameworks that a Financial Compliance Officer should be familiar with?” or “How do you handle conflicts between compliance requirements and business objectives?”

- 着装得体,面试成功!

"一份有效的简历不能仅仅罗列工作职责。谈谈你做了什么,做得怎么样。重点放在行动、影响和结果上。你做了什么,为公司做了什么,你的行动最终产生了什么结果。你的简历应该尽可能长,以说服读者你是这份工作的合适人选"。阿拉斯加美国 FCU 合规经理 Jarrett Wright Carson

- Be resilient and maintain your professionalism at all times. Build your reputation as an ethical Financial Compliance Officer who offers feasible ideas and solutions to problems

- Constantly listen to and learn from other seasoned professionals so you can avoid issues they may have encountered

- 表现出承担更多责任和处理日益复杂任务的意愿

- Knock out additional education and training to improve your technical skills

- Keep growing your professional network. Attend events, conferences, and workshops

- Seek feedback from supervisors and colleagues to identify areas for improvement

- Consider relocating or switching employers if necessary to achieve career goals

- Stay informed about industry trends and changes by reading industry publications and joining professional associations

- Develop your analytical skills to analyze complex data and identify potential compliance risks. Learn about new programs and technologies

- Cultivate strong communication skills to explain complex regulations clearly to different stakeholders

- Demonstrate leadership by leading compliance projects, mentoring junior staff, and contributing to your team’s success

- Be detail-oriented in reviewing documents, monitoring compliance activities, and ensuring all regulatory requirements are met

- Build strong relationships with regulatory bodies to better understand their expectations and facilitate smoother compliance audits and inspections

- Foster a culture of compliance within your organization by training staff, promoting ethical behavior, and ensuring everyone understands the importance of compliance.

"牺牲和奉献。牺牲你不需要或不应该做的事情,去做你知道会帮助你变得更好的事情。为你的计划奉献。你的计划将帮助你实现总体目标"。阿拉斯加美国 FCU 合规经理 Jarrett Wright Carson

网站

- 美国银行家协会

- American Compliance Association

- Association of Certified Anti-Money Laundering Specialists

- Association of Certified Chief Financial Officers

- Bankers Online

- Compliance & Ethics Blog

- Compliance Today

- Compliance Week

- Corporate Compliance Insights

- 金融业监管局

- Global Association of Risk Professionals

- Institute for Financial Markets

- 内部审计师协会

- International Compliance Association

- Journal of Financial Compliance

- National Association of State Boards of Accountancy

- National Society of Compliance Professionals

- Regulatory Compliance Watch

- Risk & Compliance Journal

- Risk Management Association

- Securities and Exchange Commission

- Thomson Reuters Compliance Learning

书籍

- Financial Regulation: Law and Policy by Michael S. Barr

- Principles of Financial Regulation, by John Armour, et. al.

- The Essentials of Risk Management by Michel Crouhy, et. al.

Financial Compliance Officers bear professional responsibility for keeping their organizations compliant with numerous regulations. Sometimes, mistakes still happen and companies get fined or even prosecuted. In rare cases, the compliance officers themselves may face personal liability if they also made mistakes. As a result, it is important to weigh the career’s rewards with its potential risks!

For those who want to explore alternative career paths that rely on similar skills, check out our list below.

- 报关员

- 文件管理专家

- 环境合规督察

- 平等机会代表

- 财务分析师

- Forensic Accountant

- 政府财产检查员

- Internal Auditor

- Quality Control Systems Manager

- Regulatory Affairs Manager

- Risk Manager

银行合规部隶属于一个更大的金融审查小组。它不仅要帮助企业解决法律问题,还要帮助企业解决道德问题。如果您想帮助防止欺诈或其他财务问题,这是一条极佳的职业道路。这些人,在他们的最佳状态下,可以帮助组织蓬勃发展,同时真正帮助他们的客户。

您需要精通法律事务,并具备一定的金融知识。

新闻联播

特色工作

在线课程和工具